Make an investment in their future that pays off now!

Don’t miss this opportunity, enroll today! Contact our Development Director, LaDonna Sinsabaugh, at 757-420-2455 or [email protected]

Example Donation and Tax Savings

Married Taxpayers with taxable income of $165,000 per year

Itemize deductions

| Donation Amount | $10,000 |

| Virginia Scholarships Tax Credit (65%) | -$6,500 |

| Federal Tax Savings of charitable contribution (22%) | -$2,200 |

| Virginia Tax Savings of charitable contribution (5.75%) | -$575 |

| Total Tax Savings | -$7,541 |

| NET COST OF $10,000 DONATION | $ 725 |

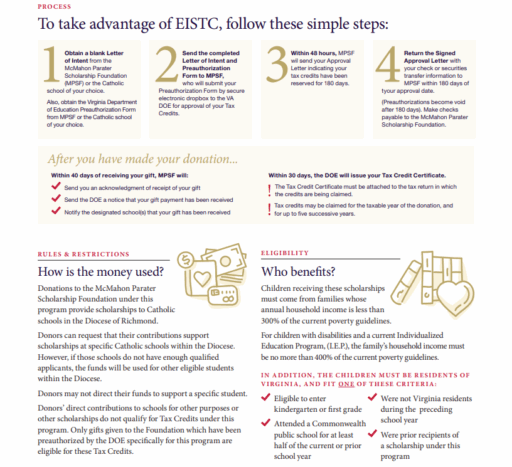

What to do?

- Download the VA DOE Authorization form and the Letter of Intent. Please designate St. Matthew’s Catholic School on your Letter of Intent. This will ensure one of our students will benefit from your generosity.

- Send the completed form and letter of intent to Joyce Schreiber, Director of the McMahon Parater Foundation for Education (MPFE), Catholic Diocese of Richmond – Contact Info: (804) 622-5190 or scan and email it to [email protected]

Then

- The VA DOE reviews and authorizes the donation, then emails you a numbered Preauthorization Notice.

- Sign the numbered Preauthorization Notice and send to MPFE with the donation within 180 days.

- VA DOE will send you a tax credit certificate.

FOUR (4) FACTS – Reasons to Support EISTC for St. Matthew’s School

FACT 1 – EISTC enables students from low to middle income families an opportunity for private education that creates a path to successful futures. You receive a tax credit.

FACT 2 – EISTC provides the path for young students to receive rigorous academic instruction, which is enhanced by our Catholic faith and morality along with a character and leadership component found in our “Leader In Me” program. You receive a tax credit.

FACT 3 – We are more than just uniforms! St. Matthew’s Catholic School accepts students of all faiths and learning abilities. Our “Blue Ribbon” school was founded in 1963 and has adhered to its belief of making Catholic education affordable to all who desire a private education. Almost 300 St. Matthew’s School students receive some form of financial aid, which equates to approximately 62% of our student population.

FACT 4 – Catholic school students score in the Top 10% in the nation on Standardized Tests and 12% above the national average on SAT scores. There is a 99% high school graduation rate & 95% of graduates attend post-secondary schools with over $30 million in scholarships awarded to members of the Class of 2022. YOU can make a Catholic education possible, receive a tax credit, and contribute to a St. Matthew’s Student’s future success!